Stonewell Bookkeeping Fundamentals Explained

Wiki Article

The Facts About Stonewell Bookkeeping Uncovered

Table of ContentsGetting The Stonewell Bookkeeping To WorkAll About Stonewell BookkeepingFacts About Stonewell Bookkeeping UncoveredStonewell Bookkeeping Can Be Fun For AnyoneThe Ultimate Guide To Stonewell Bookkeeping

Every service, from hand-crafted towel manufacturers to video game designers to dining establishment chains, earns and invests cash. Bookkeepers help you track all of it. What do they really do? It's hard understanding all the response to this question if you have actually been only concentrated on expanding your organization. You might not completely recognize or perhaps begin to fully appreciate what a bookkeeper does.The history of bookkeeping days back to the beginning of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants kept documents on clay tablet computers to maintain accounts of deals in remote cities. In colonial America, a Waste Schedule was typically utilized in accounting. It contained a day-to-day diary of every purchase in the chronological order.

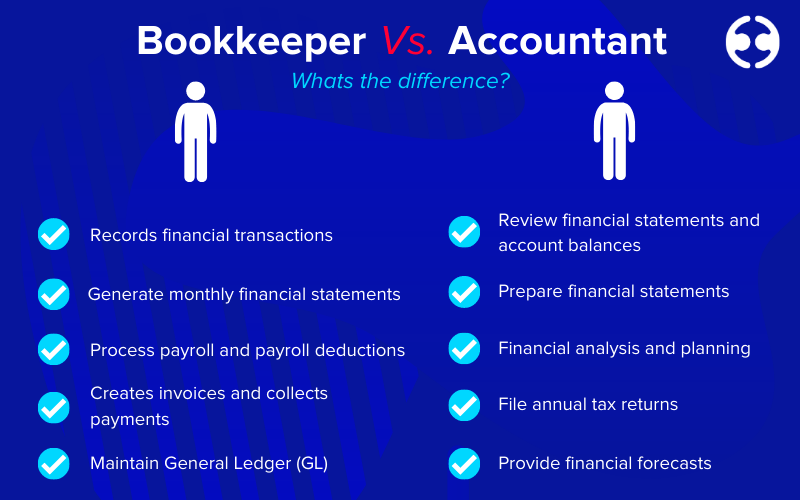

Local business may count solely on a bookkeeper initially, yet as they grow, having both experts aboard ends up being progressively beneficial. There are 2 primary sorts of bookkeeping: single-entry and double-entry bookkeeping. documents one side of a financial transaction, such as including $100 to your expense account when you make a $100 purchase with your credit rating card.

Little Known Questions About Stonewell Bookkeeping.

While low-cost, it's time consuming and prone to errors - https://bizidex.com/en/stonewell-bookkeeping-business-services-848464. These systems automatically sync with your credit card networks to give you debt card purchase information in real-time, and automatically code all information around costs consisting of jobs, GL codes, locations, and classifications.They ensure that all paperwork follows tax guidelines and policies. They monitor money flow and consistently create monetary records that aid vital decision-makers in an organization to press business ahead. Furthermore, some bookkeepers also assist in enhancing pay-roll and billing generation for an organization. A successful bookkeeper requires the following skills: Precision is vital in monetary recordkeeping.

They generally start with a macro point of view, such as an equilibrium sheet or an earnings and loss declaration, and afterwards drill into the details. Bookkeepers make sure that vendor and image source client records are constantly as much as day, even as people and organizations change. They may likewise require to collaborate with other departments to make sure that every person is utilizing the exact same data.

Unknown Facts About Stonewell Bookkeeping

Getting in bills right into the accountancy system permits for exact preparation and decision-making. This helps companies obtain payments much faster and boost cash money flow.This assists prevent inconsistencies. Bookkeepers consistently conduct physical stock counts to avoid overemphasizing the worth of properties. This is a vital facet that auditors very carefully analyze. Include internal auditors and compare their matters with the recorded values. Bookkeepers can function as freelancers or internal staff members, and their settlement varies relying on the nature of their work.

That being stated,. This variant is affected by factors like place, experience, and ability degree. Freelancers commonly bill by the hour however may use flat-rate packages for particular tasks. According to the US Bureau of Labor Stats, the ordinary accountant income in the United States is. Bear in mind that salaries can vary depending on experience, education and learning, place, and industry.

That being stated,. This variant is affected by factors like place, experience, and ability degree. Freelancers commonly bill by the hour however may use flat-rate packages for particular tasks. According to the US Bureau of Labor Stats, the ordinary accountant income in the United States is. Bear in mind that salaries can vary depending on experience, education and learning, place, and industry.The Facts About Stonewell Bookkeeping Uncovered

Several of the most common paperwork that organizations need to send to the federal government includesTransaction info Financial statementsTax compliance reportsCash circulation reportsIf your accounting depends on day all year, you can stay clear of a bunch of stress during tax season. franchise opportunities. Persistence and attention to detail are key to far better accounting

Seasonality is a part of any kind of job on the planet. For accountants, seasonality suggests durations when settlements come flying in with the roofing system, where having outstanding job can become a severe blocker. It comes to be crucial to expect these moments ahead of time and to finish any stockpile before the pressure duration hits.

Stonewell Bookkeeping Fundamentals Explained

Avoiding this will certainly decrease the risk of setting off an internal revenue service audit as it provides an exact depiction of your finances. Some typical to maintain your personal and business funds separate areUsing a business bank card for all your company expensesHaving different checking accountsKeeping invoices for individual and overhead separate Visualize a world where your accounting is done for you.Workers can respond to this message with an image of the receipt, and it will immediately match it for you! Sage Cost Management uses extremely personalized two-way integrations with copyright Online, copyright Desktop Computer, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These assimilations are self-serve and call for no coding. It can instantly import information such as workers, tasks, classifications, GL codes, divisions, task codes, expense codes, taxes, and more, while exporting costs as bills, journal entrances, or credit card fees in real-time.

Think about the following tips: An accountant that has worked with businesses in your market will certainly better understand your specific needs. Certifications like those from AIPB or NACPB can be a sign of reliability and capability. Ask for referrals or examine online reviews to guarantee you're employing a person reputable. is a great location to begin.

Report this wiki page